Are Patents Evil? – An Economist's Perspective

Posted on Wednesday, March 2, 2011

By Bravo Li, NAIP Editorial

As rational members of a capitalist society, we are, for the most part, trained to see monopolies as bad for the market. Monopolies create artificially high prices. They stifle competition. They steal candy from children and other evil acts. We also know, as IP industry professionals, that patents are essentially monopolies granted by the government. Therefore, through specious reasoning, patents are evil. Right?

Well, that depends on who you ask. Here, we will take a quick, simplified look at this question from an economist's perspective to answer this question, hopefully once and for all.

A Economist's Definition of Patents: Monopolies Granted & Enforced by a Government

In economics, a government-granted monopoly is also called a de jure monopoly, which is a coercive monopoly. Potential competitors are excluded from the market owing to regulations or other governmental mechanism of enforcement. This coercive power comes from an exclusive privilege granted by a government to a private individual or firm to be the only provider of a good or service. Patents are examples of government-granted monopolies; so are copyright and trademarks.

How Does a Monopolist Maximize Profit?

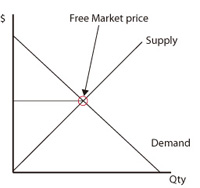

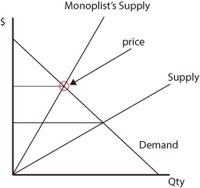

To understand how a monopolist maximizes its profits (and acts all evil in the process), first we must understand a fundamental tenet of economics: The lower the price of a normal good, the higher the overall demand for that good. This states an inverse relationship between price and demand and a downward-sloping demand curve. Furthermore, suppliers of a product produce more as the price goes up, and less if the price goes down. This means an upward sloping supply curve. The intersection of these two curves is the market price. In a market where supply is controlled by a monopolist, however, the supply curve is comparatively steeper—meaning the price at which a product is sold in the market is higher, but the quantity sold is lower. The monopolist does this simply because it wishes to maximize its profits. For those interested in a brief discussion of that math and economics involved, please see the addendum. |   |

Monopolies Are Evil – The Evidence

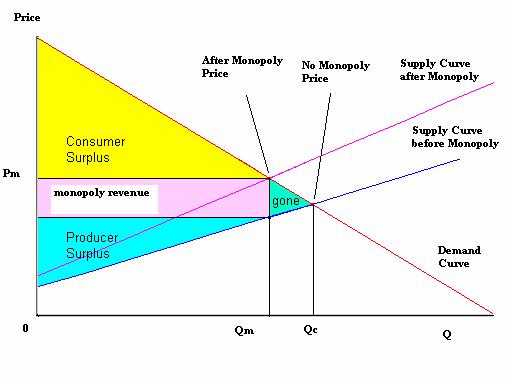

Monopolies are considered evil because they cause a net loss to a society's welfare or wealth, which is called "dead weight loss"(see graph 2).

Graph 2

Deadweight loss is the inefficiency caused by, for example, monopoly pricing. By causing a difference between the pre-monopoly price received by a monopoly firm and the post-monopoly price paid by consumers, the monopoly firm secures a profit, or "surplus", represented by the pink area labeled monopoly revenue. This revenue comes at the expense of the consumer surplus (in yellow) and producer surplus (in blue) that would have existed in the free market equilibrium. The blue "gone" triangle of deadweight loss goes to no one because the monopoly pricing has prevented those transactions. This loss represents the inefficiency and vice of patent monopolies claimed by anti-patent advocates.

But… Not All Monopolies Are Not Evil

In economics, a more benign denotation for "dead weight loss" exists: Rent.

Whereas the term "dead weight loss" suggests that monopoly pricing results in overall waste, the term "rent" suggests that society is somehow subsidizing the monopoly's existence. These terms have undoubtedly caused much contention in economic studies. But which one is more accurate for a patent monopoly?

The following is the profit maximization formula for a monopolist:

TR(Q) is the monopolist's total revenue and TC(Q) is the total cost. π(Q) represents the profit level of a monopoly producer when the production quantity reaches Q.

If for any reason the profit function π(Q) is (or is predicted to be) 0, the production quantity Q of a monopoly will be zero. No rationale producer would be willing to continue any production activity without profit. And as strange as it seems, some situations do exist in which without any government subsidies or "rents", producers would not produce anything—even if buyers do exist.

Imagine a subway system. Would any business be willing to build an extensive system that, once completed, could be utilized by any other company without fees? Furthermore, would any company build that subway system if the population of that city were only 1000 people? The issue is in fixed costs and market uncertainty—two areas for which patents and their potential are notoriously unreliable.

Patents Are Monopolies that Need Special Care

Each year, inventors and organizations spend billions of dollars to develop and file their inventions as patents. Each year, some of these inventions go on to revolutionize (or create) markets, even changing the way societies run. But only some. The rest of these ideas, even if they become patents, sit stacked and unused, representing billion of dollars wasted and countless producers run out of business. The reasons why ideas and patents go unused vary, but regardless of the exact reason, the result is simple: despite a potential market existing and potential gain available for capture, the producer sees no potential for profit and therefore does not produce.

Fortunately, the potential of ideas are so strong, governments have implemented policies, subsidies and many more methods to encourage their continual generation and commercialization. Patents are simply one of these methods. And, therefore, in this light, we can see that some monopolies, such as patents, do require these "rents". The utility, innovation, and novelty offered by a successful patent can potentially bring huge benefit to society. And these benefits justify paying "rent" to a patent owner for its monopolistic existence.

So are patent monopolies evil? With this basic understanding of economics and the nature of market monopolies, we can easily see that "evil patent monopoly" is an overstatement.

Conclusion

Patents do demonstrate some characteristics of a monopoly, specifically: exclusive ownership as a sole provider of a technology through legal privilege and command of supply. The key point, however, is that a patent, which is a government-granted monopoly, differs from a market monopoly, government monopoly, state monopoly or government-sponsored cartels. Unlike a general monopoly with unlimited life span, a patent may easily become outdated before even making the owner any profit. This may be due to the pace of the technological development. It may be due to the official granted time limit. But to ensure that an idea can spread its benefits to others, governments have instituted systems that have created what we now know as Patents. Which are definitely not evil. Just misunderstood.

Addendum:

Profit Maximization for a Monopoly – The Math

Any supplier must be aware of two things: Marginal cost (MC), which signifies the increase increment in total cost by producing one more unit; and marginal revenue (MR), the incremental increase in total revenue by producing and selling one more unit.

A rational supplier therefore attempts to maximize its profits by producing at the point where its marginal cost is equal to its marginal revenue (MC = MR). A monopolist is no exception.

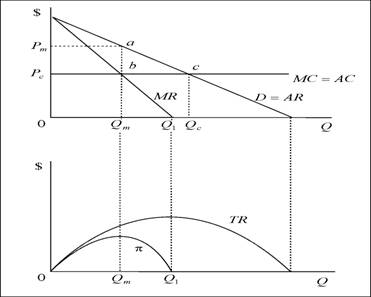

There is a single seller in a monopoly. A monopolist can affect the price and quantity of goods to maximize its profit unlike a price taker whose marginal revenue (MRm) is given by the competitive market price (see graph 1).

Graph 1: monopoly market

In a market monopoly, though, the scenario is a lower quantity (Qm) of goods sold at a higher price (Pm). The slope of a monopolist's marginal revenue curve (MR) is twice the slope of the market demand curve, compared to the competitive market situation (quantity Qc at price Pc). Consumers have to pay more for the same good, and there are less available. Under this market structure, a monopolistic producer therefore gains profits that a competitive producer could not.

In economics, the total revenue and the total cost of a monopoly are expressed by functions TR(Q)and TC(Q), respectively. π(Q) represents the profit level of a monopoly producer when the production quantity reaches Q. The profit maximization of a monopoly can be shown as follows.

--------------eq. 1

--------------eq. 1

The necessary (but not sufficient) condition for the profit maximization of a monopoly is:

-----------eq. 2

-----------eq. 2

Furthermore the production quantity of a monopoly for profit maximization is greater than zero:  > 0

> 0

and

and  are the marginal revenue marginal cost of a monopoly respectively.

are the marginal revenue marginal cost of a monopoly respectively.

I really enjoy reading the post, thanks for sharing I really like it, I already bookmarked it, thank you guys.